Smart Loan Calculator Remedy: Improving Your Economic Computations

In the realm of monetary management, efficiency and precision are critical. Think of a device that not only simplifies complex financing estimations yet likewise supplies real-time understandings into your financial commitments. The clever finance calculator option is developed to enhance your monetary computations, providing a smooth method to assess and prepare your finances. By utilizing the power of automation and progressed algorithms, this tool goes past simple number crunching, reinventing the method you approach economic preparation. Whether you are an experienced financier or a novice borrower, this ingenious remedy guarantees to redefine your monetary decision-making process.

Advantages of Smart Lending Calculator

When analyzing economic alternatives, the advantages of using a clever lending calculator come to be noticeable in assisting in informed decision-making. By inputting variables such as finance quantity, interest price, and term length, individuals can analyze numerous circumstances to choose the most cost-efficient choice tailored to their monetary scenario.

Additionally, smart car loan calculators offer transparency by breaking down the complete expense of loaning, including interest repayments and any added charges. This openness empowers customers to understand the financial effects of getting a lending, enabling them to make audio monetary choices. Additionally, these devices can conserve time by providing instantaneous estimations, eliminating the demand for intricate spread sheets or hands-on computations.

Attributes of the Tool

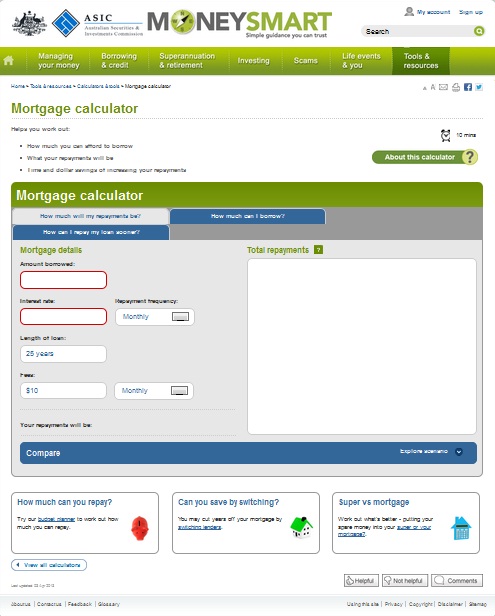

The tool incorporates a straightforward interface made to streamline the process of inputting and examining lending information effectively. Customers can easily input variables such as funding amount, rates of interest, and lending term, permitting for quick computations of regular monthly repayments and total passion over the car loan term. The device likewise uses the versatility to change these variables to see just how changes influence the general car loan terms, encouraging individuals to make educated economic choices.

Additionally, the clever financing calculator supplies a break down of each month-to-month payment, revealing the portion that goes towards the principal quantity and the interest. This feature aids users visualize just how their payments add to paying off the car loan over time. In addition, users can produce in-depth amortization timetables, which lay out the repayment schedule and rate of interest paid every month, aiding in long-lasting financial planning.

How to Use the Calculator

In navigating the financing calculator effectively, customers can quickly take advantage of the straightforward interface to input key variables and produce important monetary understandings. To begin making use of the calculator, users ought to first input the car loan quantity they are thinking about. This is commonly the complete quantity of cash borrowed from a lender. Next, individuals need to get in the financing term, which refers to the duration over which the car loan will certainly be settled. Following this, the rate of interest must be inputted, as this considerably affects the general expense of the funding. Individuals can likewise specify the repayment frequency, whether it's monthly, quarterly, or yearly, to line up with their financial planning. Once all necessary areas are finished, pushing the 'Determine' button will swiftly process the info and supply necessary details such as the monthly payment amount, overall rate of interest payable, and general finance expense. By complying with these easy actions, individuals can successfully use the finance calculator to make educated monetary decisions.

Benefits of Automated Computations

Automated calculations enhance monetary procedures by swiftly and properly calculating intricate figures. Hand-operated estimations are vulnerable to blunders, which can have significant implications for economic choices.

Moreover, automated computations conserve time and rise performance. Complicated financial calculations that would generally take a considerable quantity of time to finish by hand can be carried out in a portion of the time with automated devices. This permits monetary professionals to focus on examining the outcomes and making educated choices rather than spending hours on computation.

Additionally, automated computations offer uniformity in results. The formulas utilized in these tools follow the very same reasoning whenever, ensuring that the estimations are uniform and trustworthy. This uniformity is vital for contrasting various financial situations and making audio monetary selections based upon accurate information. Overall, the advantages of automated calculations in enhancing monetary processes are undeniable, supplying raised precision, effectiveness, and consistency in complex economic computations.

Enhancing Financial Preparation

Enhancing economic planning includes leveraging innovative devices and techniques to maximize financial decision-making processes. By using sophisticated monetary planning software application and individuals, businesses and calculators can acquire deeper useful link insights right into their monetary health and wellness, set sensible objectives, and establish actionable plans to achieve them. These devices can evaluate numerous monetary scenarios, job future end results, and offer referrals for reliable riches monitoring and threat mitigation.

Additionally, enhancing monetary preparation encompasses integrating automation and expert system into the process. Automation can enhance regular economic jobs, such as budgeting, cost monitoring, and financial investment tracking, liberating time for calculated decision-making and evaluation. AI-powered devices can use individualized monetary recommendations, determine fads, and suggest ideal investment chances based upon private danger profiles and economic objectives.

Moreover, cooperation with monetary experts and specialists can improve monetary preparation by using important insights, industry understanding, and customized techniques customized to certain economic goals and circumstances. By incorporating innovative devices, automation, AI, and expert guidance, services and individuals can elevate their economic planning capabilities and make informed choices to safeguard their economic future.

Verdict

Finally, the smart car loan calculator option supplies many benefits and attributes for simplifying monetary calculations - home loan calculator. By using this device, customers can quickly compute loan payments, rate of interest, and payment timetables with accuracy and performance. The automated computations supplied by the calculator enhance economic planning and decision-making procedures, ultimately bring about much better monetary management and informed choices

The clever financing calculator remedy is developed to streamline your economic calculations, news offering a smooth way to examine and plan your loans. In general, the advantages of automated computations in simplifying financial procedures are undeniable, offering raised precision, efficiency, and uniformity in complex economic computations.

By using advanced monetary preparation software application and calculators, people and organizations can get deeper insights into their monetary health, set reasonable objectives, and create actionable strategies to achieve them. AI-powered great site tools can supply tailored financial suggestions, identify trends, and suggest optimal investment opportunities based on private threat profiles and financial purposes.

Comments on “Discover How a Home Loan Calculator Can Streamline Your Mortgage Planning”